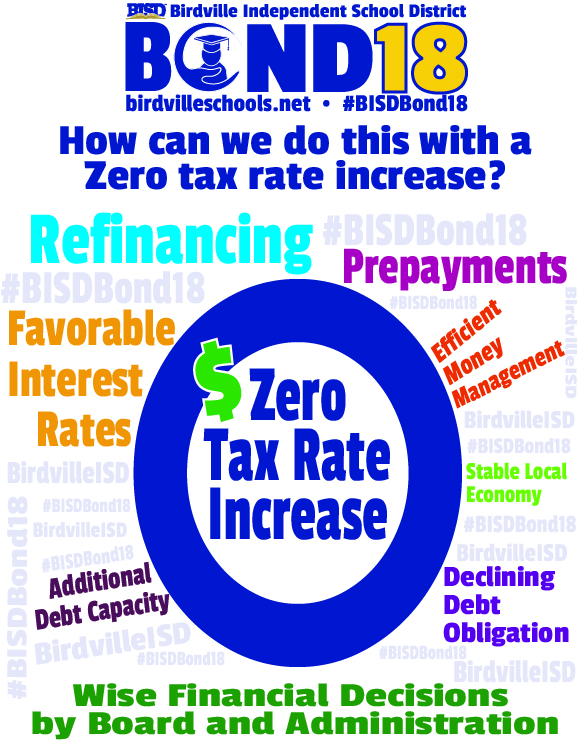

The efficient management of the BISD’s existing bond debt over the last six years has allowed the District to refinance more than $142.2 million of its outstanding bonds at a lower interest rate, saving taxpayers $18,360,986 in future interest costs. The District has also prepaid approximately $16.3 million of its bonds prior to scheduled maturity, saving an additional $11,102,560 for taxpayers. BISD will continue to carefully monitor its bond debt and related interest rates in an effort to save taxpayers additional dollars in the future.

The District repays its bonds on an annual basis over a period of 25 years or less, while structuring its annual bond payments to decline over time creating additional bonding capacity for future bond proposals. Furthermore, the District repays its bonds based upon the useful life of the assets for which the District is financing. As an example, BISD repays bonds issued for new school buildings over a 25-year period, but repays bonds issued for technology and other short-term assets over a period of 3 to 10 years.

Birdville ISD will have the ability to sell these additional bonds with NO school tax rate increase due to bond prepayments and the refinancing of current bonds at lower interest rates.

Please note: Birdville ISD Communications Departments reserves the right to delete comments that are offensive or off-topic.